Infrastructure Asset Management: the backbone of municipal capital planning

Capital planning is seldom a straight-forward process because it requires organizations to predict their needs long-term. In order to better predict what assets need to be replaced, what big projects need to be prioritized, and where to invest, asset-intensive organizations like municipalities should use infrastructure asset management to bolster their municipal capital planning.

OPEX vs. CAPEX

Before we get into what infrastructure asset management is and how it complements capital planning, we must go over the difference between operating budgets and capital budgets.

Operating budgets cover the ongoing, day-to-day expenses a municipality incurs. Think staff salaries, emergency services, social services, and recreation. These are primarily funded through property taxes and fees.

It’s the municipal equivalent of buying groceries, paying rent, and other bills.

Capital budgets, on the other hand, cover long-term investments in the purchase, construction, and maintenance of facilities or infrastructure. Any work on roads, bridges, libraries, parks, and clean water which are funded by property taxes, government grants, and debt financing.

It’s the municipal equivalent of buying a new car, a new couch, or fixing a roof. Large purchases that should, in theory, last for years.

| Operating Budgets | Capital Budgets |

|---|---|

| One year | Multi-year |

| Personnel expenses | Facility upgrades or replacements |

| Maintenance materials | Sustainability plans |

| Fuel | Land acquisition |

What is infrastructure asset management?

Infrastructure asset management is a specific type of asset management focusing on physical assets rather than financial ones.

Rather than manage stocks and bonds, the goal is to sustainably manage the lifecycle of bridges, roads, water treatment facilities, sewer lines, and more.

Because bridges, sewers, and water mains are expensive to build and maintain, it is critical that they remain in good working order for years to come. Effective infrastructure asset management ensures these assets are properly maintained and upgraded as needed, extending their lifespan, preventing costly failures, and optimizing the use of public funds.

This directly ties into capital budgets, as the planning, allocation, and management of capital funds are essential for the long-term sustainability and functionality of these vital infrastructure assets. By integrating infrastructure asset management with capital planning, municipalities can make more informed decisions, prioritize investments, and ensure that their capital budgets are used efficiently to support the community’s needs.

Proactive vs. reactive infrastructure asset management

There is a subtle but important difference between “managing your infrastructure” and “infrastructure asset management.”

And it’s the difference between being proactive and reactive.

Some asset-intensive organizations can deliver safe, reliable service simply by conducting maintenance when an issue arises. Reactively managing their infrastructure assets ensures issues are resolved, but this practice lacks the foresight necessary for effective capital planning.

While there will always be some reactivity required in infrastructure asset management, proactive asset management involves organizations collecting data, building models, and simulating potential outcomes with technology like Asset Investment Planning software to prevent problems before they occur.

Considering the overall age, health, and condition of every infrastructure asset in a municipality’s portfolio and predicting how it will perform long-term not only prolongs the life of critical assets but also enables cities to make more accurate capital plans.

Creating capital plans with infrastructure asset management

Because capital plans consist of multi-year investments in complex projects like upgrading infrastructure, it benefits everyone involved by providing long-term visibility on asset and financial performance, quantifiable benefits and trade-offs metrics, and contingencies of the chosen investments.

Predicting asset and investment performance

If a municipality is conducting proactive infrastructure asset management, they’ll have a wealth of historical data to draw on to reveal trends on assets’ age, use, underlying condition, and when it’s most likely to fail or when it ceases to be cost-effective to maintain.

Leveraging these trends can help identify patterns and insights that are crucial for making informed capital planning decisions. For example, understanding the typical lifecycle of various assets allows municipalities to schedule timely upgrades or replacements, allocate resources more efficiently, and develop targeted maintenance strategies.

This can be done through spreadsheets or even by hand, but a solution built specifically to assess the long-term performance of assets and investments yields the best results.

Quantifiable metrics

Most people only notice public infrastructure when it doesn’t work. And this is true even in the capital planning phase.

It can be difficult to get more funding to repair a segment of water infrastructure. Until it breaks and several citizens are left without water for days.

To prevent such costly service disruptions, it’s crucial to quantify the risk of delaying investments. Better yet, it shows how investing more now will make budgets more sustainable in the future. This helps illustrate the immediate need for funding and highlights the importance of timely infrastructure improvements.

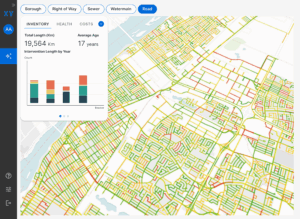

Again, this can be done in a spreadsheet or by hand. But a solution with advanced mapping and visualization tools could better demonstrate the value to the community.

Contingencies and alternate investment scenarios

A lot can change in a year. Let alone 5 or 10…

With this in mind, capital plans must also account for uncertainties.

Unfortunately, even the best infrastructure asset management practices can’t prevent a historic storm from upending these best-laid plans.

As new risks, unforeseen costs, regulatory changes, and strategic priorities emerge, it’s important for municipalities to consider contingencies and alternate investment scenarios to ensure their capital plans remain resilient.

Particularly in municipalities, some capital plans may depend on specific federal or provincial funding programs. And it would benefit cities to have an alternate plan if the funding is not awarded or pulled.

With a clear, long-term image of what they need to do, how much it could cost, and when they need to do it that infrastructure asset management enables, municipal capital plans become more strategic, targeted, and adaptable, allowing municipalities to effectively prioritize investments, allocate resources efficiently, and respond proactively to emerging challenges and opportunities.

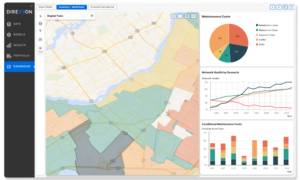

Creating multiple investment scenarios can theoretically be done with spreadsheets or by hand, but rarely is it practical. To create a variety of investment scenarios that consider different budget allocations, funding sources, and the entirety of an infrastructure asset portfolio, the best bet is Direxyon.

Municipal infrastructure asset management and capital planning solutions

For over a decade, Direxyon has helped municipalities improve their infrastructure asset management and capital planning.

Our turnkey infrastructure asset management and capital planning solutions give municipalities:

– Centralized asset data management

– Editable decision trees

– Simulation and investment scenario modeling

– Advanced visualization and mapping tools

In doing so, municipalities can predict, measure, and gain valuable insights to optimize their investments.

Find out how Direxyon can improve your capital planning and contact us today.