Why a risk management approach in capital investment planning is critical

What constitutes risks for power utilities? Historically, they’ve prioritized immediate, short-term economic risk above all others. But this singular focus can be short-sighted. A true risk management approach should help identify, assess, and prioritize any potential challenges and outcomes over the long term.

Some asset-intensive industries are broadening their risk assessments to include geo-political factors, supply-chain considerations, and threats posed by environmental or climate issues. Allowing them to make informed decisions about how to allocate their capital, develop strategies that mitigate those risks and optimize performance.

While each utility will have its own risk value framework and challenges relevant to them, all effective risk management strategies should cover:

- Risk identification

- Risk analysis

- Risk mitigation

Whether you’re looking to optimize your current risk management process, implement a more far-reaching approach or just starting to look beyond the boundaries of cost, you’ll find a comprehensive overview below of some key constraints and risks that you should be aware of and mitigating against, so you can determine the best course of action to reach your goals.

Then with the addition of the right technology, utilities can transform their investment objectives into measurable metrics, which can then be used to forecast the potential performance and risks of an investment, and in turn inform decisions about where and how much to invest.

Risk identification

The concept of risk management grows more complex each year. New threats, increased weather events in terms of quantity and severity, the evolving role of the energy consumer to prosumer, utilities must have a clear eye on what is coming down the road and have a clear understanding of the potential impacts or trade-offs they may have to contend with in the future.

But risk can look different for each utility. And a key part of risk identification comes from the understanding of the organization’s risk tolerance. What’s a more likely scenario for your utility: that your assets fail in service (based on age, general condition, etc.) or from an external factor, like an extreme weather event?

Once a risk is identified, the team needs to calculate the probability of that event taking place, the likelihood it will lead to a failure and then the consequence of that failure.

On a scale of one to five, one representing a very low risk and five a very high risk, utilities can tier the exposure they face. One utility may need to be on high alert when it comes to vegetation management because of an elevated risk of wildfires.

Another may be able to do fewer interventions in area A versus area B, because area A is very remote with isolated infrastructure and a low risk of an explosion taking place, but area B is near an urban area with many feeders, and an explosion would have dire consequences.

Risk analysis: Where to start

A comprehensive investment strategy that uses a long-term view of these constraints and considers all potential returns and risks associated with investments is the only way to determine the best course of action.

Overall, capital planning software can provide users with a wide range of tools and resources to better understand the risks they face, and plan how to avoid or mitigate them. It is important to have both short- and long-term views of these issues and the multiple factors that can impact them.

Economic risks

When considering short-term and long-term economic risks in capital investment planning, several key considerations should be kept in mind:

- Understanding the available investment budget, including any constraints or limitations that may impact the ability to make the investment.

- Considering the impact of capital expenditure (CapEx) and operational expenditure (OpEx) on the total cost of an investment, now and in the future.

- Determining the total cost of ownership (TCO), including all costs associated with the investment over its life cycle, such as maintenance, upgrades, and replacement costs.

- Considering short- and long-term economic risks, such as changes in market conditions, interest rates, currency fluctuations, commodity prices, and political stability, all of which can impact the performance of the investment over time.

Supply chain risk

It is important for capital investment planning to consider and mitigate supply chain risk to protect the utility’s bottom line and maintain a competitive advantage, by evaluating the following:

- Identifying suppliers critical to the production of the investment and ensuring their ability to meet the required quantity and quality of goods and services.

- Evaluating the risk associated with each supplier, considering factors such as their financial stability, production capacity, and geographical location.

- Diversifying the supplier base to reduce the risk of a single supplier failure. This could include identifying alternative suppliers or maintaining relationships with multiple suppliers to mitigate potential disruptions.

- Monitoring supplier performance and any issues or disruptions that occur to quickly identify and address potential problems.

- Developing mitigation strategies to address potential supply chain disruptions, such as stockpiling critical materials or components, or outsourcing production to multiple suppliers.

- Ensuring that suppliers are compliant with relevant laws and regulations, and that they meet the company’s ethical and environmental standards.

Reputational risk

Utilities can develop a robust reputational risk management strategy that will help protect the company’s reputation, which is critical for the success of any capital investment plan. Several key considerations could be made:

- Identifying potential risks that could impact on the company’s reputation, such as negative media coverage, legal or regulatory issues, or social or environmental concerns.

- Assessing the potential impact of these risks on the company’s reputation, including the impact on the company’s brand, customer relationships, and financial performance.

- Engaging with key stakeholders, such as customers, employees, and shareholders, to understand their concerns and expectations, and forging strong relationships that can be leveraged in the event of a reputational crisis.

- Ensuring compliance with relevant laws and regulations and that it operates in an ethically and socially responsible way.

Performance risk

It’s important for capital investment planning to consider and mitigate performance risk by investing in quality control measures and monitoring, including a robust contingency plan in case of service failure to minimize the following potential risks:

- Identifying potential risks that could impact the performance of the investment, such as equipment failure, human error, or external factors such as natural disasters or cyber-attacks.

- Defining expectations for the investment, including the availability, reliability, and performance of the service or asset..

- Monitoring the performance of the investment, including tracking key performance indicators, to quickly identify and respond to potential issues.

Climate risks

Good capital investment planning involves identifying potential risks and impacts associated with climate change and taking steps to mitigate or adapt to those risks, which could comprise:

- Assessing the physical risks and forecasting impact of extreme weather events, such as floods, droughts, and heatwaves, on the assets being invested in.

- Evaluating the transition risks and potential impact of policy and market changes related to the transition to a low-carbon economy on the assets being invested in.

- Incorporating climate scenarios and models to evaluate the potential impact of different levels of climate warming on the assets being invested in, as well as identify potential opportunities and vulnerabilities.

- Integrating climate risk into investment analysis and decision-making, then using this information to inform investment decisions.

- Monitoring investments for climate risks and disclosing this information to stakeholders, including investors, regulators, and the public.

Environmental risks

In capital investment planning, identifying potential risks and impacts associated with the environmental footprint of the assets being invested in, and taking steps to mitigate or adapt to those risks is key. This process might consider:

- Assessing the potential impact of the assets being invested in on the surrounding area and community, such as through the release of pollutants or the destruction of natural habitats.

- Evaluating regulatory compliance and the potential impact of environmental regulations, both current and future, on the assets being invested in.

- Weighing the long-term sustainability of the assets being invested in, through renewable energy or resource-efficient technologies.

- Evaluating the environmental, social, and governance (ESG) performance of the assets being invested in and how it aligns with investor’s values, goals, and objectives.

Regulatory risks

Regulatory risk management in capital investment planning includes identifying potential risks and impacts associated with government regulations and laws, and complying with or adapting to those regulations, in ways such as:

- Evaluating regulatory compliance and the potential impact of existing and future regulations on the assets being invested in, such as environmental regulations, labor laws, and financial regulations.

- Considering the regulatory environment, such as the stability, predictability, and consistency of the regulatory environment in which the assets are being invested in, as well as the likelihood of changes in regulations.

- Assessing political risk and potential impact of political changes, such as changes in government leadership or policy, on the assets being invested in.

- Identifying potential legal and financial implications, like liabilities associated with non-compliance with regulations and laws, and taking steps to mitigate those risks.

- Monitoring investments for regulatory risks and disclosing this information to stakeholders, including investors, regulators, and the public.

- Ensuring governance and compliance practices—such as appointing compliance officers, regular compliance training, and governance audits—are in place and adhered to.

Asset-level risks

In capital investment planning, asset-level risk management involves identifying potential impacts associated with investment assets and taking steps to mitigate or adapt to those risks. Some considerations to keep in mind include for the assets being invested in:

- Assessing the potential impact of natural disasters, such as floods, earthquakes, and storms.

- Evaluating operational risks, like equipment failure or supply chain disruptions.

- Considering the potential impact of market changes, such as changes in demand or price.

- Assessing the potential financial risks, such as credit risk, liquidity risk, and market risk, associated with the assets being invested in.

- Using ‘what-if scenario’ analysis to evaluate the potential impact of different scenarios and to identify potential opportunities and vulnerabilities.

Blog – Wildfire risk mitigation: An asset perspective

Risk mitigation: Which steps to take

An ideal approach to risk management is both a top-down and bottom-up method, one that considers the various types of risks outlined above and handles those at the project level, so that risk-reduction strategies at the portfolio level becomes easier to manage.

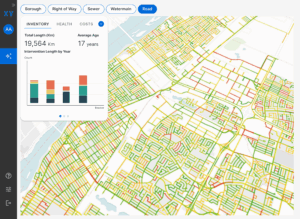

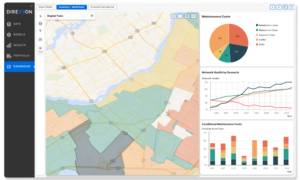

Capital planning technologies can support decision makers in achieving a balance between risks, costs, and performance of assets and critical infrastructure by providing them with a comprehensive and integrated view of all relevant data and information. Using an AIP solution, decision makers can:

- Identify potential risks and vulnerabilities in the assets and infrastructure, then assess the likelihood and severity of different types of threats.

- Optimize the performance of assets and infrastructure by simulating different scenarios, such as different maintenance schedules, capacity upgrades, or changes in operating conditions.

- Evaluate the costs and benefits of different options to identify the most cost-effective solutions that also meet the required performance and risk management objectives.

- Monitor the real-time performance of assets and receive alerts when potential issues or deviations from expected behavior are detected.

- Communicate and collaborate with stakeholders, such as regulators, operators, and investors, by providing them with access to digital models and associated data and information.

The benefits of a risk management approach are clear. Managing and balancing risks, costs, and the performance of assets and critical infrastructure are central to effective capital investment planning. It won’t help you predict the future, but it will let you plan for it.