Electric Utilities Thrive with DIREXYON Suite Asset Investment Planning

January 7, 2022What is Asset Investment Planning?

Asset Investment Planning is a newer approach to asset management and capital planning that enables organizations to use data-driven insights to optimize their infrastructure investments over time.

Because Asset Investment Planning (AIP) solutions integrate data and expertise from financial, asset management, regulatory, risk, and operations divisions, asset-intensive organizations can create a holistic, integrated view of their operations. As a result, these platforms are essential for comprehensive strategic planning.

Table of Contents

What is asset management?

Asset management is the practice of balancing costs, opportunities, and risks against the desired performance of assets. Ultimately, if the assets perform well, strategic goals are achieved.

The ability to develop optimal asset and investment strategies for meeting long-term performance and risk targets is crucial in high-capital industries.

Today, with aging infrastructure and the need for climate adaptation, organizations increasingly rely on specialized software. Specifically, software designed to process large volumes of data and predict an asset’s future performance.

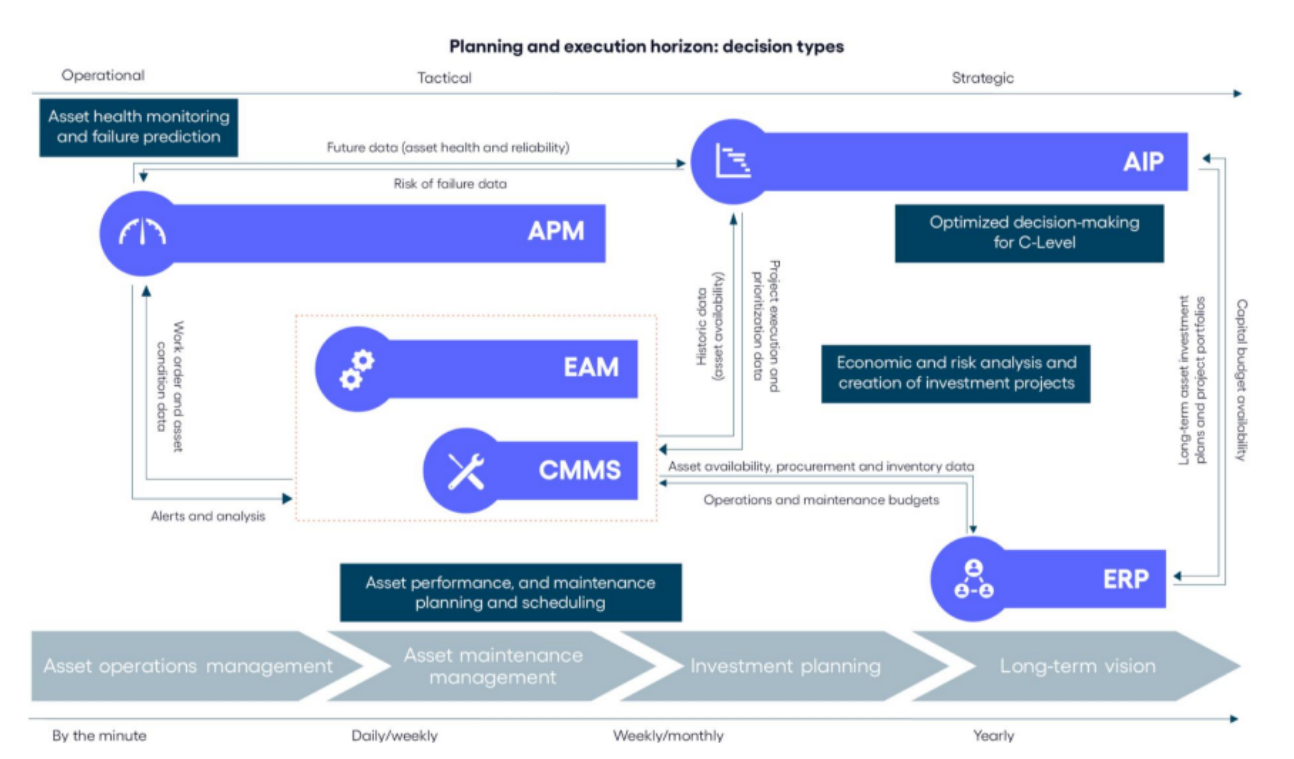

The three core asset management tools on the market today are: Enterprise Asset Management (EAM), Asset Performance Management (APM), and Asset Investment Planning (AIP).

Enterprise Asset Management (EAM) vs. Asset Performance Management (APM)

Enterprise Asset Management (EAM) focuses on the maintenance, procurement, and tracking. EAM software typically manages and predicts the day-to-day operations of assets, ensuring optimal performance.

Meanwhile, Asset Performance Management (APM) leverages advanced analytics and predictive capabilities to monitor asset health, identify potential issues before they escalate, and optimize maintenance schedules. APM software targets the month-to-month, tactical level to enhance efficiency and drive higher returns on investment.

How does Asset Investment Planning (AIP) fit in asset management?

The main limitations with traditional asset management is that it provides organizations with a static view of their assets. Predicting the future performance of assets and investments from historical data is a challenge. Especially with so many data points across so many disparate systems.

Asset Investment Planning solutions can take data from any source, vendor, or format — including EAMs and APMs — and simulate possible futures. Leveraging predictive modeling and Monte-Carlo simulation, organizations use AIP to assess the long-term performance of their assets and investments.

Additionally, AIP solutions integrate perspectives from asset, finance, regulatory, and operations to find the optimal long-term investment strategy.

Why adopt an AIP solution?

Adopting an AIP solution allows organizations to shift from a traditional, reactive approach to a long-term, strategic asset management and spending. As a result, organizations achieve more effective resource planning and gain a better understanding of which investments are ideal the long term.

Strategic Asset Management

By extracting data from asset management systems and leveraging business analytics, AIP solutions help organizations justify planned capital expenditures on infrastructure. This approach provides a repeatable, credible, and highly accurate methodology for planning infrastructure spending. As a result, it reduces the possibility of human error and bias in large capital investment decisions.

The Data Advantage: How AIP Enhances Infrastructure Investment

Asset-intensive organizations can also use AIP applications to structure their decision-making policies and processes to provide knowledge and information that is useful both vertically for a wide range of stakeholders, including senior management and operations staff, as well as horizontally across departments, including finance, public works, and engineering.

Maximizing Efficiency: AIP's Role in CAPEX/OPEX Optimization

Organizations can leverage AIP applications to:

– Structure their decision-making policies and processes to provide knowledge and information that is useful both vertically for a wide range of stakeholders, including senior management and operations staff, as well as horizontally across departments, including finance, public works, and engineering.

– Optimize CAPEX/OPEX spending by producing ‘what-if’ scenarios using data-driven analytics and complex computer modeling to analyze different strategic approaches and make accurate decisions affecting asset maintenance and policy.

– Better prioritization of renewal and maintenance activities.

– Synchronize multiple projects for optimal returns.

– Explore different revenue opportunities for a specific business unit, service, or product by determining ways to improve service levels in that area.

– Explore the transformative capabilities of advanced asset investment planning (AIP) solutions in revolutionizing strategic asset management. With cutting-edge technology and data-driven approaches, AIP empowers organizations to optimize asset management strategies, mitigate risks, and maximize returns.

Curious about the benefits of asset investment planning (AIP)? Learn more about all the benefits of asset investment planning (AIP).

The future of strategic asset management: Investing in AIP

AIP represents the next step in strategic asset management tools, especially for high-risk, high-capital industries. As modern infrastructure becomes more complex and demands for efficiency and reliability grow, traditional asset management approaches fall short.

Using an AIP solution to analyze different scenarios and options, optimize investments, and quantify risks becomes essential. Consequently, organizations can make informed long-term capital investment decisions. This approach increases the probability of meeting objectives while aligning with client-driven and modifiable decision-making policies.

The Power of Direxyon

Discover the transformative capabilities of Direxyon’s AIP solution in advancing strategic asset and capital investment planning.

With its cutting-edge technology and data-driven approach, Direxyon empowers organizations to optimize their asset management strategies, mitigate risks, and maximize returns. Experience firsthand how Direxyon can revolutionize your organization’s asset investment planning processes.

Contact us today to schedule a personalized demo of our Direxyon Suite to learn more about how Direxyon’s AIP software products can drive growth and efficiency for your business.

Asset Investment Planning FAQs

Asset Investment Planning (AIP) software enhances the long-term, strategic thinking of asset-intensive organizations to optimize performance and minimize risk. By consolidating asset, financial, and regulatory data in a single solution, alongside organization-specific decision-making policies and predictive models, organizations can simulate possible futures and test investment scenarios to make informed decisions aligned with their strategic goals. Learn more about our AIP software.

Traditional asset management often focuses on day-to-day operations and reactive maintenance, relying on historical data and experience rather than predictive analytics and strategic planning. It typically does not prioritize immediate needs over long-term planning and may not integrate financial considerations or advanced risk management strategies as comprehensively as Asset Investment Planning.

Asset Investment Planning is not a standalone process but rather integrative across an organization. It provides a holistic approach to managing assets, factoring in risk, finance, regulatory requirements, operations, and more. In integrating all these aspects of a single organization, silos are replaced by strategic alignment.

The first step to adopting an AIP is to book a demo with Direxyon.