What is an "Asset-Centric" AIP?

Asset Investment Planning solutions can offer valuable insight to strategically allocate resources, optimize investments, and bridge the gap between day-to-day operations and long-term strategic objectives.

Broadly speaking, there are two types of Asset Investment Planning solutions: project-centric and asset-centric. And while both have their advantages, there are important differences between the two, which can greatly influence the insight these solutions generate.

Table of Contents

Project-centric vs. asset-centric AIP

When organizations adopt an Asset Investment Planning (AIP) solution, they are able to model multiple, long-term investment scenarios, creating clarity around where to allocate resources to achieve their strategic goals.

But before an organization starts making informed decisions about their assets, risk, and finances, they must first decide if their goals are better served by a project-centric or asset-centric AIP.

Project-centric AIP

Project-centric AIP solutions focus on projects as the primary driver of investment decisions.

These solutions typically emphasize how individual projects fit within the broader portfolio, helping decision-makers evaluate the feasibility and potential impact of each project within the context of an organization’s financial constraints.

Project-centric AIP solutions often involve tools for project tracking, budget management, and resource allocation, ensuring that projects are completed on time and within budget. The overarching objective is to optimize the execution of projects, balancing resource availability and ensuring that each project aligns with organizational goals.

Asset-centric AIP

Asset-centric AIP solutions take a more granular approach than their project-centric counterparts.

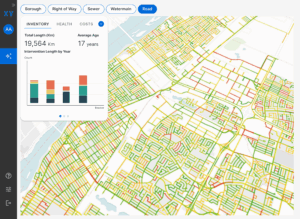

These solutions place the assets at the center of all investment decisions, tying decisions to the specific condition, lifecycle stage, and value of each asset. Each intervention, whether it’s maintenance, repairs, or replacements, is driven by the asset’s needs.

By centering investment decisions on the assets, organizations get a clear picture of prioritizing which assets require investment based on their criticality, age, or risk. Asset-centric AIP solutions help maximize the value of assets long-term, ensuring that they are maintained in a way that extends their lifecycle, reduces downtime or overall risk, that they are being managed sustainably, achieving regulatory compliance, or bridging any strategic priorities into day-to-day operations.

In focusing on the overall health, performance, risk, and cost of assets, organizations get a recommended prioritization of interventions based on their constraints and objectives to ensure the long-term sustainability and efficiency of their asset portfolio.

While project-centric AIP solutions optimize the successful delivery of multiple projects, asset-centric solutions ensure investment decisions are made to balance the immediate operational needs with long-term, strategic asset management objectives.

Planning interventions with an asset-centric AIP

Though the terms “asset-centric” and “project-centric” might suggest that only project-centric approaches focus on planning projects, asset-centric AIP solutions are equally effective at doing so. The key difference is that asset-centric AIPs, such as Direxyon’s AIP, consider each individual asset within the portfolio to ensure that the planned projects have the intended impact on the assets themselves, aligning short-term actions with long-term asset performance goals.

In an asset-centric AIP, interventions (such as repairs or replacements) are guided by decision-making processes that are modeled within decision trees. These decision trees simulate how an organization typically approaches asset maintenance and improvements based on specific triggers or conditions tied to the asset’s performance, condition, or lifecycle.

For instance, if a road’s Pavement Condition Index (PCI) drops below a certain threshold, the decision tree might automatically recommend resurfacing that road segment. This ensures that interventions are planned systematically and are driven by the actual condition of the assets, rather than solely by project timelines or budgets.

By using decision trees, asset-centric AIPs help organizations predict, prioritize, and plan interventions in a way that maximizes the value of their assets over time. This approach not only facilitates effective project planning but also ensures that each project serves its purpose—improving or maintaining asset performance in line with the organization’s overall asset management strategy.

Additionally, organizations reconfigure decision trees to how different intervention strategies impact their overall investment strategies.

For example, if the resurfacing intervention is triggered when the road’s PCI reaches 30, what’s the long-term impact of intervening at 40? By being more proactive, the organization may find there’s a higher up-front cost, but their road assets’ lifecycles are significantly extended.

Creating an intervention plan with an asset-centric AIP

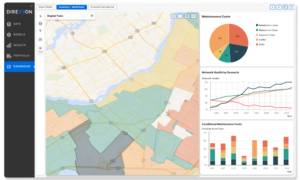

Once decision-making policies are applied to each asset-type, an asset-centric AIP can generate a list of recommended interventions in addition to a long-term outlook spanning over 100 years.

In Direxyon, this is known as a Project Portfolio, found in the Portfolio module of the AIP. And the Project Portfolio’s list of recommended interventions can range anywhere from 1 to 10 years. This ensures that short-term decisions remain aligned with the organization’s overarching asset management objectives.

What makes the Project Portfolio especially valuable is its flexibility in prioritizing interventions based on the specific investment scenario at hand. For instance, if budget constraints or urgent asset needs demand a focus on critical infrastructure, the portfolio can adapt accordingly, offering a prioritized list of interventions based on urgency, cost, and impact.

For example, if a transportation asset, like a bridge, is approaching the end of its expected lifecycle but still meets safety standards, the decision-making policies might recommend monitoring or minor repairs in the immediate term, followed by more significant investments in the next 5 years.

By using the Project Portfolio to map out these interventions, the organization can ensure that essential infrastructure is maintained in the short term while budgeting for a major overhaul when it’s truly needed.

Alternatively, a Project Portfolio can be used as an input for a long-term simulation. Meaning that existing intervention plans can be simulated long-term to refine the impact of already-scheduled interventions. By evaluating how existing interventions play out in the long run, organizations can better allocate their resources based on the expected return.

Direxyon's asset-centric AIP

Direxyon is the only asset-centric and user-configurable AIP solution for impactful capital planning and investment strategy.

By making sure that every decision is centered around the assets themselves, organizations can easily optimize resources, maintain their assets, and align long-term strategic priorities and day-to-day operations.

To learn more about Direxyon’s asset-centric AIP, contact us today.