The future of infrastructure starts with how we prioritize

With an infrastructure deficit in the billions—and rising—we can’t continue to do things the way we’ve always done them. The approach we’ve been using has led us to where we are now, with critical assets aging rapidly and budgets too tight to adequately address the issue.

If we have any hope of creating sustainable infrastructure, we must change how we prioritize our infrastructure decisions. A direct, transparent, evidence-based approach that looks beyond short-term wins is key.

Table of Contents

Reactive, short-term planning

Despite infrastructure being the backbone of daily life—supporting transportation, public safety, clean water, and economic activity—it is too often treated as an afterthought. Funding is frequently allocated in response to crises rather than as part of a proactive strategy. Essential maintenance is deferred, leading to greater deterioration and exponentially higher costs down the line.

This cycle of reactive planning puts us in a perpetual state of crisis management. Emergency repairs become more frequent, service disruptions impact businesses and residents, and critical projects struggle to secure funding because resources are funneled toward urgent fixes instead of long-term solutions.

By shifting toward a proactive, strategic approach that prioritizes long-term resilience, we can break free from this cycle. Investing in preventative maintenance, risk-based asset management, and scenario-based planning allows us to maximize every dollar spent—extending asset lifespans, improving service reliability, and ensuring infrastructure is built to withstand future challenges, from climate change to evolving urban demands.

The future of infrastructure depends on the choices we make today. It’s time to prioritize smarter.

Asset Investment Planning (AIP): A smarter approach to infrastructure planning

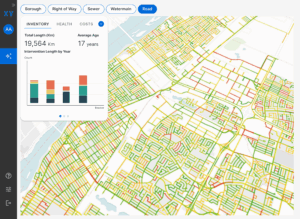

Rather than acting reactively, a more effective way to address infrastructure challenges is by leveraging Asset Investment Planning (AIP)—a structured, evidence-based approach that ensures investments are made strategically.

AIP enables municipalities and higher levels of government to systematically simulate the evolution of assets and investments to evaluate projects based on risk, long-term value, and lifecycle costs, ensuring that funds are allocated where they will have the greatest impact.

By creating long-term infrastructure strategies that align with the best interests of a community, the appropriate funding can be allocated to the projects that provide lasting value.

Transparent, data-driven decision-making with AIP

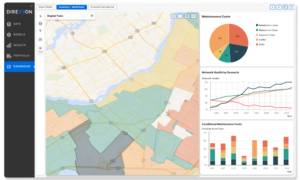

Traditional infrastructure planning often relies on static asset management plans that, while useful, lack the dynamic capabilities needed to evaluate future scenarios and optimize investments over time. Asset Investment Planning (AIP) modernizes this approach by integrating advanced data analytics, risk modeling, and financial forecasting to ensure every dollar spent delivers maximum long-term value.

By implementing AIP methodologies, governments can:

Prioritize infrastructure projects based on risk, need, and long-term impact

AIP enables decision-makers to assess projects using a structured, quantifiable framework rather than relying on subjective preferences or immediate political pressures.

By simulating the evolution of assets under different conditions and constraints, municipalities can identify which projects carry the highest risks, where infrastructure failure would have the most severe consequences, and where investment will yield the greatest long-term benefits.

This ensures that limited resources are directed toward the most urgent and impactful projects.

Optimize funding allocation to prevent costly, short-term fixes

A common challenge in infrastructure management is the tendency to fund urgent, visible problems rather than addressing root causes. AIP helps governments break this reactive cycle by optimizing funding allocation based on lifecycle costs.

Instead of spending on short-term fixes that lead to recurring maintenance expenses, AIP encourages preventative maintenance and long-term capital planning, ultimately reducing overall costs and extending asset lifespans.

Improve coordination across infrastructure investments

Without a structured approach, infrastructure projects are often planned in isolation, leading to inefficiencies, redundancies, and missed opportunities for integration. Roads get repaved only to be torn up months later for utility work, or large-scale developments proceed without adequate supporting infrastructure.

AIP enables governments to take a holistic view of infrastructure needs by aligning projects across different asset classes and jurisdictions. By simulating various investment scenarios, AIP helps identify opportunities for coordination—ensuring that transportation, water, energy, and other critical systems are planned together, reducing costs and minimizing disruptions.

The path forward

Canada’s infrastructure deficit is too large—and too urgent—to be managed without a clear, strategic vision.

Our future depends on making smart, strategic infrastructure investments today. It’s time to use the tools we have—Asset Investment Planning—to get the job done right.