Maximizing mitigation with risk-spend efficiency

Risk professionals face increasing scrutiny, especially in the energy sector, where they must identify threats, develop mitigation strategies, and ensure compliance with stricter regulations—all while maintaining operational efficiency and financial performance.

Though many tools exist to assess risk severity and mitigation strategies, the real challenge lies in quantifying the impact of investments on risk—and determining whether they are efficient.

An Asset Investment Planning (AIP) solution enables electric utilities to optimize risk mitigation by developing risk-spend efficiency models that balance safety, cost, and sustainability.

Table of Contents

What is risk-spend efficiency?

Risk-spend efficiency is a concept that’s gained traction in the utility sector. Notably, the California Public Utility Commission and California’s investor-owned utilities use risk-spend efficiency as a framework to prioritize wildfire mitigations that do the most to reduce risk per dollar invested.

In short, risk-spend efficiency seeks to optimize the balance between risk mitigation and financial investment, making sure that every dollar is providing the greatest possible return on safety, reliability, and financial sustainability.

For example, an electric utility could significantly reduce their wildfire risk if they underground the majority of their powerlines. However, while it would be effective in reducing risk, it is financially prohibitive due to the immense cost involved.

Evaluating their mitigation strategies for risk spend efficiency, the utility can find a more practical, cost-effective solution which could combine undergrounding critical segments, enhanced vegetation management, and installing weather-resistant poles to maximize risk reduction while staying within budget constraints.

Though risk-spend efficiency is already commonplace in California, it’s something electric utilities globally should adopt because the demands for electrification, aging infrastructure, and more frequent extreme weather events is something we all must contend with.

And risk-spend efficiency provides a structured, data-driven approach to making these difficult decisions.

Using a risk-spend efficiency approach

Risk-spend efficiency is a data-driven, predictive approach that shifts away from intuition-based decision-making, leading utilities to make informed decisions about the overall effectiveness of their risk mitigations.

Every dollar invested should lead to the greatest possible reduction in risk, providing a high return on investment in terms of safety, reliability, and long-term sustainability.

To assess the risk-spend efficiency of one or several investment strategies, a few things need to be in place:

Risk assessment

Risk-spend efficiency begins with a thorough analysis of potential risks that could impact operations, such as equipment failure, natural disasters, compliance issues. The utility needs to understand the probability and severity of each risk to prioritize mitigation efforts effectively.

For example, aging infrastructure may pose a significant risk of failure, while the rising demand from electrification introduces new operational challenges. By assessing each risk based on its likelihood and potential impact on service reliability, financial performance, and safety, utilities can begin to identify priority areas to address.

Cost-based analytics

Once the risks are identified, cost-based analytics determine how different levels of financial investment could mitigate those risks.

This involves calculating the cost-benefit ratio for various mitigation strategies, such as upgrading aging infrastructure or increasing vegetation management.

For each risk, risk-spend efficiency models analyze how much risk reduction can be achieved per dollar invested. And by integrating the risk assessments with the cost-based analytics, the utility can also get a holistic view of their mitigation efficiency.

By assessing the investment efficiency on individual and utility levels, utilities can better compare their options, ensuring the funds they allocate into preventative maintenance, system upgrades, or operational adjustments have the most impact.

Optimizing investment

With both risk assessment and cost-based analytics in hand, the next step is to optimize investment, controlling cost while also reducing risk as much as possible. This involves using sophisticated modeling tools that consider various investment scenarios and their potential outcomes, like an Asset Investment Planning solution.

For example, in wildfire-prone areas, a utility might explore the costs and benefits of undergrounding powerlines, installing weather-resistant infrastructure, or enhancing vegetation management. RSE helps to model these options, balancing immediate mitigation efforts against long-term operational and capital expenditures. The outcome is a strategic investment plan that minimizes risks while keeping costs within budget, creating an efficient risk-spend balance.

Data-driven decision-making

A crucial element of RSE is its reliance on data and predictive analytics. Historical data on asset performance, failure rates, and previous risk mitigation efforts are used to build accurate models of future risks. These models predict how different investments will impact risk levels over time, allowing utilities to simulate various scenarios.

For instance, by inputting data on weather patterns, equipment age, and maintenance schedules, utilities can forecast the impact of a storm on their infrastructure and evaluate the effectiveness of preemptive investments like grid hardening or enhanced storm response measures.

This data-driven approach moves organizations away from relying on intuition or reactive spending and toward proactive, informed decision-making.

Risk-spend efficiency modeling tools

Risk-spend efficiency models can be built in Excel. But Excel can easily be overwhelmed by the size of an typical utility’s dataset. The risk scores, the asset condition, and the cost analytics all processing at once is a slow process, and one that is not ideal to model and compare several different options.

A cloud-based Asset Investment Planning (AIP) solution is an ideal tool for implementing risk-spend efficiency modeling because it provides utilities with the scalability to analyze every risk, asset, and policy while making sure the scenarios respect financial and regulatory constraints.

Here’s how an AIP can be used to model risk-spend efficiency:

Integrated risk modeling

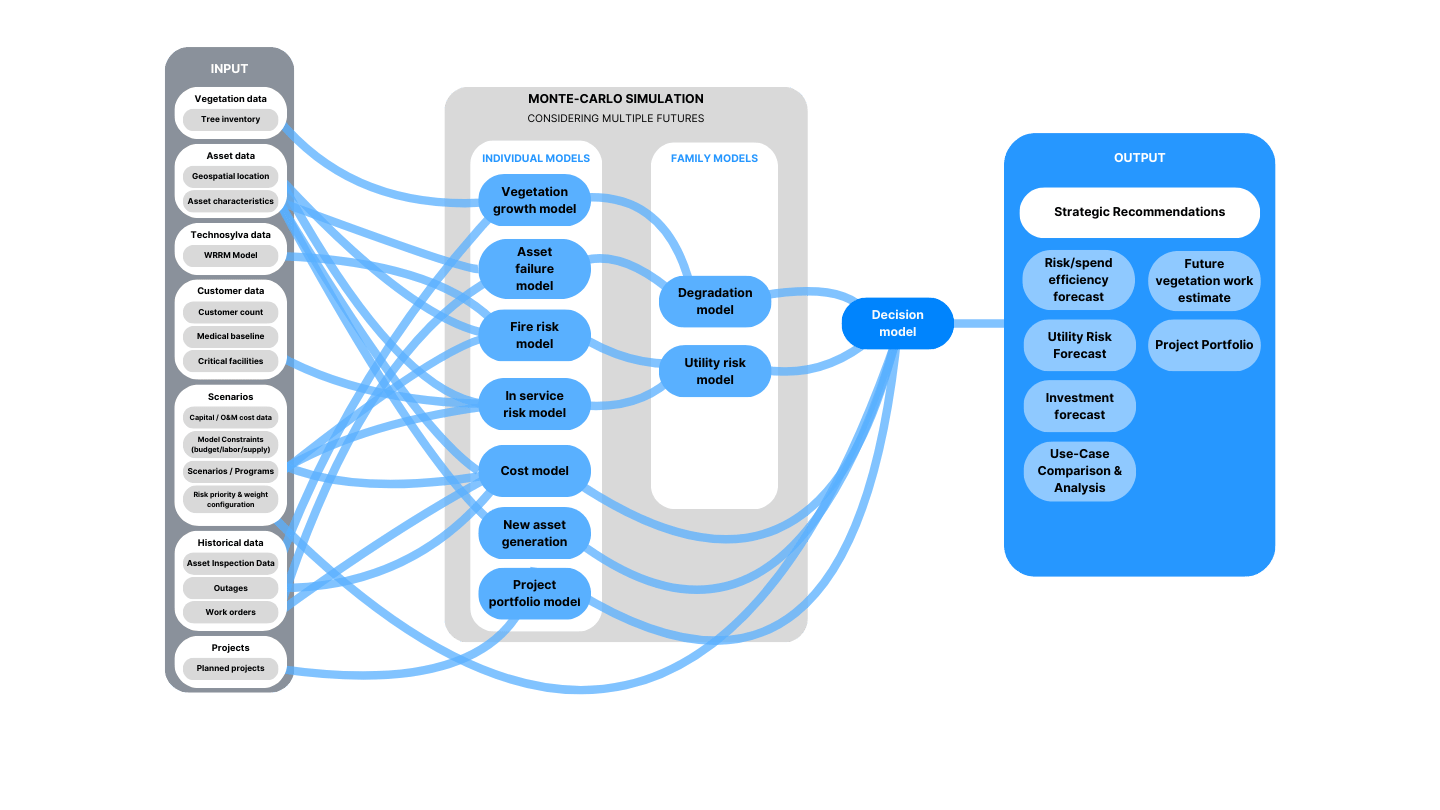

An AIP solution integrates data from various sources, including asset condition, maintenance history, network criticality, and financial profile, to create a detailed profile of all asset risk.

The individual risk assessments are then combined into a comprehensive risk portfolio, allowing utilities to see how different factors—such as aging infrastructure, operational disruptions, or extreme weather events—interact and influence overall system vulnerability. By evaluating risks at both the asset level and across the broader network, utilities can prioritize investments and mitigation strategies more effectively.

Scenario modeling and simulations

Asset Investment Planning solutions a built on the core strength of being able to create an infinite number of investment scenarios and simulate the long-term impact. The only limit is the user’s creativity.

By simulating investment scenarios with different financial constraints, intervention prioritizations and criteria, and asset-types, utilities can see how their investments impact risk reduction and identify the most cost-efficient options over the next 5 years, 20 years, all the way up to the next 100 years.

Optimized long-term planning

AIP solutions allow utilities to optimize long-term capital investment plans by modeling how risks will evolve over time. This forward-looking capability helps utilities assess when and where to invest in infrastructure upgrades, maintenance, or new technologies.

By modeling future risk factors, such as infrastructure aging or the growing impacts of climate change, the AIP solution ensures that investments are timed to preempt future risks efficiently.

Assessing risk-spend efficiency with Direxyon

A Direxyon user at an electrical utility that serves approximately 1.4 million customers recently said:

“No other tool tells us what our dollars are doing to our risk.“

While they have several tools to score and monitor risk, Direxyon’s asset-centric, user-configurable Asset Investment Planning solution allows them to assess the risk-spend efficiency of their investments. This enables them to test multiple options and find the ideal balance between cost and risk mitigation.

To find out how your risk mitigation strategies can maximize every dollar invested, book a personalized demo with Direxyon today.