Integrating Project Portfolio Management (PPM) solutions with AIP

Project Portfolio Management (PPM) solutions serve as the link between project management and the overall strategic goals of an organization. By analyzing and prioritizing the potential value of projects, a PPM can help identify which investments and initiatives can best meet the strategic goals of an organization.

At first glance, this may appear to serve the same function as Asset Investment Planning (AIP) software. However, there are key differences between these two solutions. And the ultimate value of a PPM to organizations that manage critical infrastructure lies in the ability to integrate it with an AIP.

What are Project Portfolio Management (PPM) solutions?

According to Gartner, Project Portfolio Management software, “supports the selection, planning, and execution of different work packages.”

By collecting, categorizing, and prioritizing the projects within an organization, PPM software enable leaders to maintain oversight. And with this oversight, they can ensure the projects with the highest probability of advancing strategic goals receive the attention and resources they need to realize their strategic potential.

Key features of a Project Portfolio Management solution include:

Identifying project value

In order to properly prioritize projects, decision-makers must first identify the value to an individual project relative to what else is in the portfolio.

PPMs commonly use weighted scoring criteria to criteria a standardized rubric to assess the value.

Typically, the rubrics are made up of value criteria and risk criteria.

The value criteria can consist of strategic criteria or financial criteria. Meanwhile, risk is not necessarily the individual project risks, but the overall risks associated with a project like dependencies, regulatory risk, and more.

Project management

Once the value of the projects in the portfolio have been identified, PPMs can schedule, allocate resources, manage budgets, and track performance for specific projects.

Portfolio management

Portfolio management oversees a specific collection of projects, ensuring that they align with the strategic goals as a whole.

Rather than focus solely on individual projects, the holistic overview allows decision-makers to create contingency plans, make data-driven decisions, and create strategic alignment.

Asset Investment Planning (AIP) vs. Project Portfolio Management solutions

Like Project Portfolio Management software, Asset Investment Planning (AIP) is used by organizations to test and identify which resource allocations provide the greatest strategic benefits. And while this may sound like identifying and prioritizing the most valuable projects to the uninitiated, there is a very important difference.

Asset Investment Planning (AIP) software can be both asset-centric and project-centric.

Rather than analyzing project performance, AIP simulates how assets will perform in the future based on asset data and decision-making processes, as well as the costs associated.

For example, an electrical utility can run a simulation in an AIP to see how many poles are likely to fail within the next ten years. If the potential failures exceeds their risk tolerance, will increase the frequency and duration of outages, and double emergency maintenance budgets, the utility can explore other options.

With the AIP, they can test an investment strategy that increases the number of preventative pole replacement. Alternatively, they can see if rehabilitating more poles annually can reduce the risk and the upfront costs without impacting service levels long-term.

From the investment scenarios tested, an AIP with project portfolio capabilities can then generate a list of priority projects to enact the investment strategy.

In short: A PPM can show organizations the value of their projects and how to prioritize them to serve the overall strategy.

An AIP can reveal areas of need or opportunities to optimize the project portfolio may have missed.

Combining asset-centric AIP and PPM solutions

Asset Investment Planning and Project Portfolio Management solutions can provide the decision support from two very perspectives. But these different perspective are not mutually exclusive.

Gartner captured this idea best in their Hype Cycle for Oil and Gas 2024 report by saying: “Asset-centric AIP helps clarify what decisions should be made, then informs the project-centric AIP side or a PPM tool for execution and optimization of projects.”

Let’s take a look at how this could work.

Creating investment scenarios with an asset-centric AIP

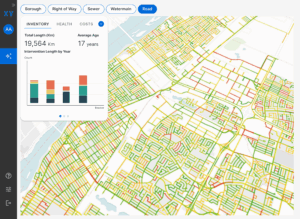

Once an asset-intensive organization, like an electric utility or municipality, has consolidated their data and created decision trees within an AIP, they can simulate a baseline scenario.

A baseline scenario is a simulation of all current practices to see how it evolves long-term. It’s an essential first step because the results of a baseline scenario often reveal CAPEX walls or risk spikes long-term.

Based on these initial results, organizations can create more investment scenarios, modifying budget allocations, decision processes, risk tolerances, and more to see which investment strategies best serve the organizations’ goals.

Once one or several investment strategies optimize achieving and sustaining the organization’s strategic goals, they can then be viewed at the project level.

Assessing the project portfolio

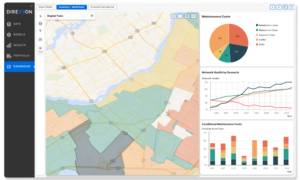

Taking the results of one or several simulations, organizations can export project portfolios.

These are recommended asset-centric projects and interventions based on investment scenario simulation results.

Existing projects can be imported into the project portfolio module and used as a source for simulation. This would then help reveal which projects are extending asset lifecycles most efficiently or where an organization might be overinvesting.

Based on the results, an organizations can generate a new portfolio based on changes to the investment scenario and then add it to a PPM to gain even more insight.

Adding simulation results to a PPM

Once the asset-centric AIP project portfolio are exported, they can be added to the Project Portfolio Management solution for greater insight.

Using the weighted scoring and prioritization methodology within the PPM, organizations can get even more evidence to make their decisions, ensuring every project in their portfolio is optimally advancing their strategic goals to reduce risk, reduce spending, and extend asset lifecycles.

An asset-centric and project-centric AIP

Direxyon’s Asset Investment Planning solution is a transparent, user-configurable platform that features both asset-centric and project-centric capabilities.

By giving organizations both the asset and project perspectives, they can effectively prioritize, allocate, and ensure strategic alignment. And when either simulation results are enriched by a Project Portfolio Management (PPM) solution or used as an input source, they have a wealth of insight to make the best long-term decisions.

For more information on how Direxyon’s AIP can benefit your organization, contact us today.