How scenario modeling helps navigate uncertainty

Scenario modeling is a valuable practice for asset-intensive organizations like electric utilities, municipalities, and government agencies. It enables these organizations to evaluate a variety of possible future events and plan accordingly.

By examining a range of possible future, not just the best-case or most likely future, organizations can capitalize on opportunities, mitigate risks, and adapt with greater resiliency.

And while it’s a great practice in theory, many organizations struggle to do it because they don’t have the right tools.

Scenario modeling vs. traditional forecasting

Traditionally, the planners forecasted three outcomes: the best, the worst, and the most likely outcome. “The most likely outcome” uses moderate assumptions with the highest probable outcome.

Although this method is simple to understand and easy to communicate, it does not capture the uncertainty we deal with today. Factors like climate change and global economic volatility demand a broader range of outcomes to be examined.

Scenario modeling considers the broader range of outcomes, enhancing an organization’s resiliency. Rather than simply test the best, worst, and most likely outcomes, organizations can test assumptions, the impact of major and minor risks, and create contingencies regardless of what happens.

Scenario modeling challenges

While extremely valuable, scenario modeling can be a complex, labor-intensive task. Especially without the right tools.

For example, it is possible to do scenario modeling in Excel. However, doing so requires personnel who can define the scenarios, calculate the probabilities, organize them in the sheets, and compare the results.

Though it is technically possible, finding or training personnel to build scenarios manually is not feasible for most organizations. By the time the scenarios are built, the organization’s needs may have already changed.

And this is another problem with the manual method. Unforeseen outcomes or unanticipated circumstances will always be a challenge. You don’t know what you don’t know. When something unaccounted for happens, more time needs to be invested into updating or redoing the work by hand.

Organizations with millions of assets we depend on like electric utilities or municipalities can’t afford to wait after an emergency.

Investment scenario modeling with Asset Investment Planning

Direxyon’s Asset Investment Planning (AIP) solution helps municipalities and electric utilities with scenario modeling by giving them a repeatable, scalable way to create and evaluate strategic investment plans.

This is achieved by:

Data, decisions, and simulation

Creating investment scenarios in Direxyon begins with data, decisions, and simulations.

Organizations can combine data from any source, format, or vendor, creating a holistic view. For example, a municipality can combine asset and financial data into a single solution.

To capture the decision-making process, configurable decision trees are used to ensure that the organization’s best practices, strategic priorities, and constraints are factored in.

For example, if a municipality’s asset managers want to replace old water infrastructure made from asbestos cement regardless of its performance or risk, that would be captured via the decision trees.

These decision trees, also known as “Decision Twins”, help ground the simulation results to reflect the organization’s current state.

Using the data and the decisions, Direxyon then simulates the future performance of assets, finances, and decisions. In doing so, organizations can see how their overall strategy performs long-term.

This is what we call a baseline scenario. These are simulation results run to chart the future performance of an organization’s current strategy.

"What if" scenario modeling

Once the baseline scenario is created, Direxyon users can reconfigure their Decision Twins to test a range of scenarios. This is known as “What if” scenario modeling because it is asset-intensive organizations creating hypothetical scenarios to assess their potential impact on project portfolios.

These what-if questions could include:

- What if we decide to accelerate the replacement of aging water infrastructure?

- What if we experience more frequent and severe weather events?

- What if our population grows faster than expected, increasing the demand for services?

- What if we raise property taxes by 2%?

- What if we synchronize our road and water infrastructure projects?

Answering these questions through manual calculations is a long, laborious process. With Direxyon, it’s just a couple of clicks to see the long-term forecast of risk, resources, and asset performance.

Additionally, with all these scenarios modeled in Direxyon, it’s easier to communicate the impact of each

Visualization and reporting

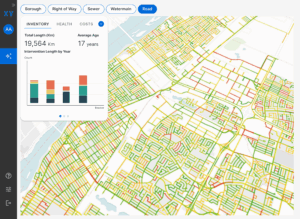

Direxyon provides visualization tools that allow stakeholders to easily compare, share, and interpret the simulations results and the holistic, potential impacts of each scenario.

Our AIP solution features configurable dashboards that include maps, line graphs, bar charts, and Gantts. Users have full flexibility to tell their investment scenario stories in the way they see fit.

By enabling stakeholders to visualize, analyze, and communicate the potential impacts of various scenarios, our solution empowers organizations to navigate uncertainty with confidence and optimize their investment strategies.

Modeling your investment scenarios

In today’s landscape, scenario modeling can’t be a slow, inaccessible process. There’s too much change, there’s too much uncertainty.

To prepare for what could happen next, a solution that can streamline, scale, and repeat the scenario modeling process is a must.

Direxyon empowers asset-intensive organization to proactively plan for any challenges. Contact us today to find out how we help you model investment scenarios.