How does Asset Performance Management integrate with AIP

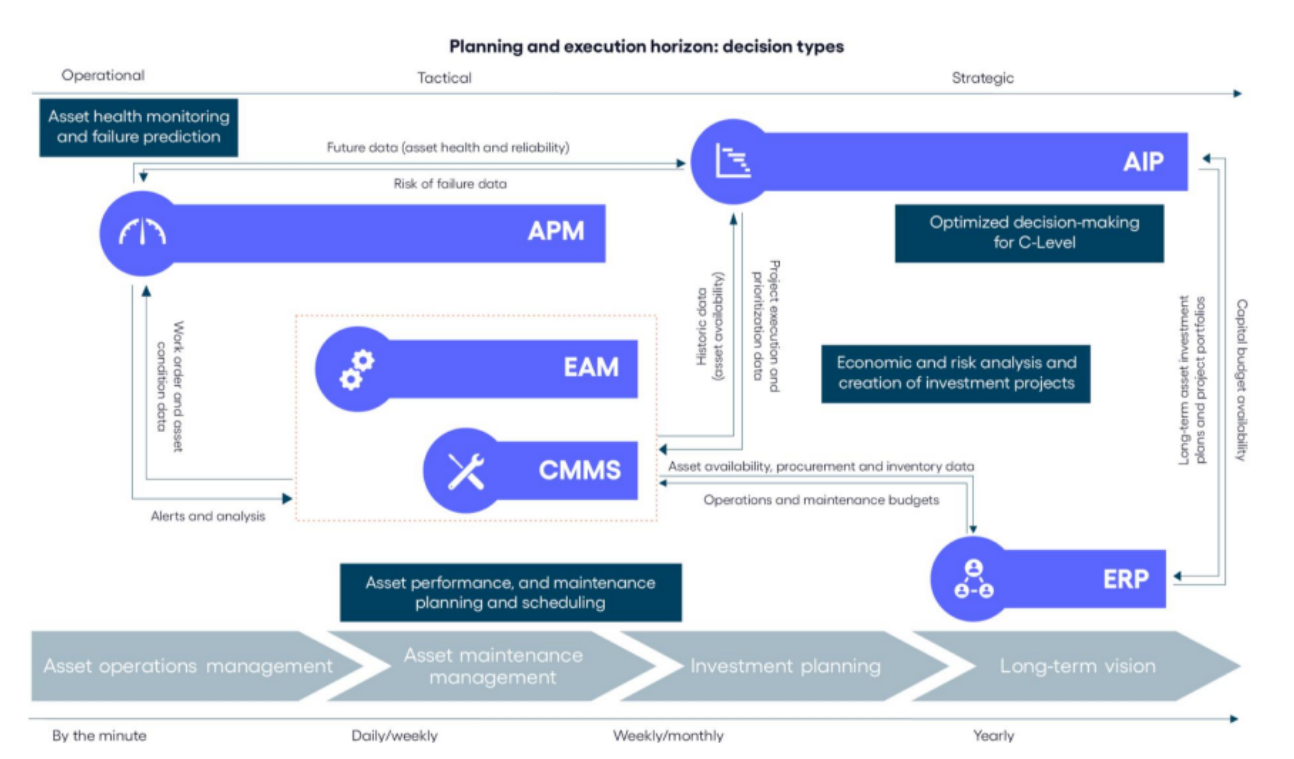

The complexity of asset management continues to increase. And to navigate the difficult decisions, organizations rely on sophisticated software solutions like Asset Performance Management and Asset Investment Planning.

The asset management software ecosystem can sometimes feel as complex as asset management itself. Let’s look at what is Asset Performance Management, Asset Investment Planning. and how they can be used as complementary systems to improve your decision-making.

What is Asset Performance Management?

Asset Performance Management (APM) software is used by asset-heavy organizations like cities, power & utilities, government agencies, and telecoms to monitor, analyze, and optimize the performance of assets across their lifecycles.

APM collects data from various sources like sensors, IoT devices, and maintenance records either stored in spreadsheets or Enterprise Asset Management systems, providing insight into the health, reliability, and efficiency of assets on the medium-term

Thanks to the continuous monitoring of asset condition, Asset Performance Management software predicts when maintenance is required, identifies areas for improvement, and evaluates asset risks to mitigate potential issues.

What is Asset Investment Planning?

Asset-intensive organizations use Asset Investment Planning (AIP) software to optimize investment strategies. They assess the condition, performance, and future requirements of assets over the long term to determine the most effective allocation of resources.

Combining various data sources ranging from asset, financial, regulatory, etc. and organizational decision policies, Asset Investment Planning software simulates the entire asset portfolio over the next 10, 25, or 50 years. The simulation generates insights on how assets degrade, the financial impact, the associated risks, etc.

From there, organizations can use the AIP to develop other investment scenarios. For example, a municipality could test the long-term impact of adopting an integrated maintenance program on its asset performance, its budget, its risk tolerance, and its levels of service.

Benefits of integrating APM with AIP

Asset Performance Management and Asset Investment Planning are complementary systems that create an end-to-end approach to asset management. This yields the highest value from their investments.

When APM and AIP are integrated, asset-heavy organizations set themselves up to create a comprehensive strategy of efficient investments while minimizing risks and sustainable performance.

Some of the value organizations can expect from integrating APM and AIP systems include:

Optimized Asset Lifecycle Management. Integration allows organizations to optimize lifecycle management by aligning maintenance and replacement schedules with long-term investment strategies. Organizations replace or repair assets at the most opportune times while continuously testing for the optimal strategy.

Proactive Investment Decisions. Organizations can make proactive investment decisions based on up-to-date asset health and performance. They allocate resources far in advance to effectively address the potential issues long before they escalate, driving down risk and minimizing downtime.

Enhanced Risk Mitigation. APM data provides valuable insights into asset risks and vulnerabilities, which AIP can ingest and use to test mitigation strategies. Through testing mitigation strategies, organizations can identify and prioritize risk mitigation measures so that they remain efficient over the long term.

Data-Driven Decision-Making. Through integration, organizations gain a holistic view of asset performance, investment requirements, and business objectives long-term. This enables informed decisions about asset management strategies, investment priorities, and resource allocation to drive better business outcomes.

Maximizing asset and investment value is no simple task without the right tools. But with the support of asset management software like Asset Performance Management and Asset Investment Planning

Asset lifecycle management with Direxyon

Direxyon’s Asset Investment Planning solutions are the only asset-centric and user-configurable solution for capital planning and investment strategy. Organizations can integrate Direxyon’s AIP with Asset Performance Management systems to create end-to-end asset lifecycle and investment optimization.

Our flexible and transparent AIP lets organizations create digital twins, model assets, model decision policies, explore possible futures, and compare scenarios through customizable dashboards.

To learn more about how Direxyon can help you achieve your strategic goals, get in touch with us today.